If Forex trading is stable, the thought always comes to try something new and get additional profit. Among these new features, brokers aggressively advertise CFDs or Contracts for Difference, which you can also find charts for in your MetaTrader terminal.

Table of contents:

Types of CFD

CFD Trading

How to trade CFD?

CFD Trading Features

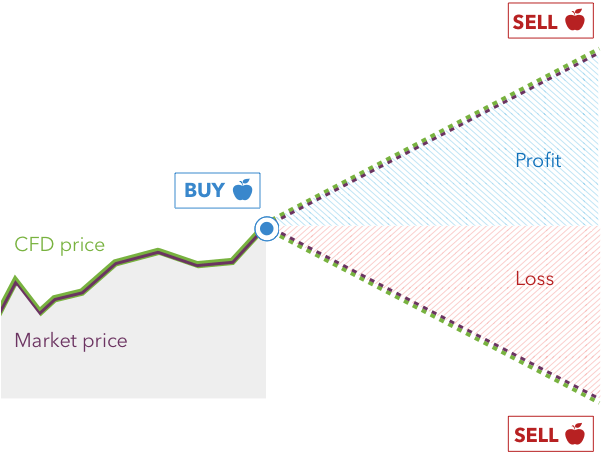

CFD contracts are a popular trading form. CFD is a contract regulating the transfer of the difference in the price of a trading asset when it is opened and the price at the time when it is closed under the agreement of the buyer and seller. If the price has increased, the difference is paid to the buyer of the contract (positive difference), in case of price reduction (negative difference), the amount is paid to the seller. The term of the contract is not governed by the exchange rules.

Contracts for price difference in different variations have existed for more than a hundred years. This topic is quite extensive and, in my opinion, worthy of a separate site. In this article, I will go over what is called “tops” so that newbies have at least a general idea of what brokers offer them for the “beast” and how to react to it.

The essence of CFD trading is that the trader and the broker make a kind of bet between themselves, according to which one of the parties will pay the other side the difference between the opening price of the transaction and the closing price of the transaction. To make it clearer, let’s take a look at an example. Suppose that today’s exchange rate is 105 yen for 1 US dollar. Trader Pete believes that the yen will rise against the dollar. Pete signs a contract with a broker for USD/JPY growth. Further two situations are possible:

- If the yen grows and the exchange rate is 95 yen per $1, the broker will have to pay Pete 10 yen;

- If the yen falls and the exchange rate is 115 yen for 1 dollar, then Pete will have to pay the broker 10 yen.

At the same time, the time of closing the contract and CFD calculation is not set in advance (as opposed to binary options, where there is a fixed expiration). The traders decide on their own at what point the transaction will be considered closed and, accordingly, what profit or what loss they will receive.

Types of CFD contracts

CFD contract can be made on any type of asset, whether it is a share, a metal or wheat. Most often, brokers provide access to the following types of contracts for difference:

- Shares of well-known company – shares of popular issuers

- Indices – the most popular indices are S&P 500, Dow Jones, Nikkei, FTSE

- Precious metals – gold and silver

- Energy – crude oil, etc.

In addition, contracts may be made on rather exotic assets – cotton, wheat, diamonds and even exotic currency pairs. Everything is limited only by the fantasy (and capabilities) of the broker.

Pros and Cons of CFD Trading

Just like any other type of trading CFD trading has its advantages and disadvantages: Let’s review both.

Advantages:

- A wide selection of instruments for diversity supporters. CFDs are presented on almost all financial instruments, including currency, raw materials, stocks, etc.

- Small traders can enter the market with a small capital. Not much is required to open a transaction.

- Low costs because you only need to pay the spread, not commission or taxes as in the case of buying shares.

- CFD value change only a little compared to currency pairs. Therefore, you can work on a longer timeframe, which increases the chances for a positive outcome.

- CFD brokers provide traders with instruments from global markets on a single platform.

- Ability to earn both on the fall and rise of the asset you are trading.

- There are no limits for short positions. According to the rules of some markets a trader takes an asset in debt before opening a short position and does not make short trades at fixed times.

- Instant transactions without commissions and limits on day trading.

Disadvantages:

- Scalping is rarely used. Spread costs. It limits fast trades and does not allow to receive income on small fluctuations. The spread on EUR / USD on Forex is 5-15 pips, while on CFD it is 2-6 times higher.

- CFDs are in demand by reputable brokers. The market is less regulated than the stocks market.

- You can loose money due to high leverage.

- If the transaction is transferred to the next day, you will need to pay the SWAP fee.

How to trade CFD?

The mechanism of trading CFD contracts is more like Forex than binary options, even the terminology is absolutely the same. That is, the trader does not earn a fixed percentage of each transaction, but the difference in the price that happened over some time. CFD trading strategies are not very different from binary options trading strategies or Forex trading (all the same models, indicators and news are used).

Just like on Forex, there are two prices in CFD trading: ASK (purchase price) and BID (selling price), and not one average (as is customary in binary options). The process of opening a CFD transaction occurs in four stages:

- The trader must choose when the transaction will be considered open. There are two options here: either the transaction will be opened immediately (at the current quotation), or the transaction will be postponed until the schedule reaches a certain price (pending order);

- Next, the trader must choose the size of the investment (or the number of lots). That is, the amount that s/he is willing to invest in one transaction;

- After that, you can set protective stop loss and take profit orders. That is, choose upon reaching what profit (or what loss) the transaction will be automatically closed;

- The last thing to choose is the size of the leverage (the leverage allows you to proportionally multiply the potential income and risks of the transaction).

You can close the order either manually (at any time) or you can wait until one of the protective orders is triggered. Take Profit – in case of reaching the specified profit or stop-loss – in case of specified loss.

CFD Trading Features

Despite the fact that opening positions and calculating profits is not different from Forex, many successful currency traders begin to incur losses when switching to CFDs, especially stocks. The main reason is an attempt to use the established methods and strategies of trade without taking into account the fundamental differences between the two markets:

- Lack of round-the-clock trading. Commodity trading is continuous on the exchanges of America, Europe, Asia and you can open an CFD at any time. With stocks, the situation is different: the main flow of quotes and transactions falls on the trading hours of stock exchanges such as the NYSE and NASDAQ for US companies. The time difference may require changing the established work schedule and trading in the evening or at night.

- The importance of fundamental analysis. Due to the globality of Forex, only important news and statistics: the unemployment rate, changes in GDP and the discount rate, speeches of the heads of Central Banks affect it. Less significant news, such as indices of business activity and consumer demand, also give price impulses, but they cannot fundamentally change the direction of the market.

The stock market is smaller. The number of players on the stock exchange is also small – most of the market is in the hands of large investment banks and funds that use CFD contracts for hedging and quick profits. All this requires processing a much larger amount of information and it is not for nothing that there are traders who mostly trade shares of only one company. - Limited application of technical analysis. A large weight of fundamental factors reduces the value of technical analysis for making trading decisions. This can be an unpleasant surprise for medium and long-term strategies where the behavior of a large market crowd is analyzed.

- Strategies do not work. Despite the previous point, it cannot be said that CFD trading does not use technical analysis at all. However, there are groups of strategies that give only losses if you simply transfer from Forex to stocks.