One Minute Trading Strategy

There are options that are executed in 60 seconds. What does it mean? This means that you can earn in a minute. All that is needed for this is options and the “60 seconds” strategy. This type of trading has become quite popular over a couple of years and a lot of trading brokers are now offering this trade to the clients. It’s important to note that it has its own advantages and disadvantages. But thanks to this strategy, it is possible earn a lot of money in a really short period of time. But at the same time 60 seconds strategy has some significant risks, which increase in regard to the rate of earnings. The mathematical model behind this trading strategy has a proven market edge.

AvaTrade 60 Seconds Strategy

The 60 Seconds Strategy is a simple and fast money making system, which includes two indicators: Bollinger Bands and RSI. The strategy is based on two indicators of technical analysis and quite accurately determines the entry and exit points of the transaction. But, before you start using this strategy, it’s important to draw your attention to one essential detail. You shouldn’t stick only on one candlestick. One particular bar can behave differently, and in general the price movement will maintain its direction, be it decreasing or increasing in its nature.

That is, if you compare the minute chart with the five-minute one, you will see a certain difference. On the minute chart, candlesticks can move in different directions, either red or green, while a clear uptrend emerges on the five-minute timeframe. For this reason, you have to have the additional time at least for the formation of three bars, in order to make a successful deal. That is why it is so important to use the minute chart when trading for five minutes, and you need a fifteen seconds timeframe when trading for a minute.

So, in order to use a 60 seconds strategy you need:

- Bollinger bands indicator

- Heiken Ashi chart, set up for 15 seconds timeframe.

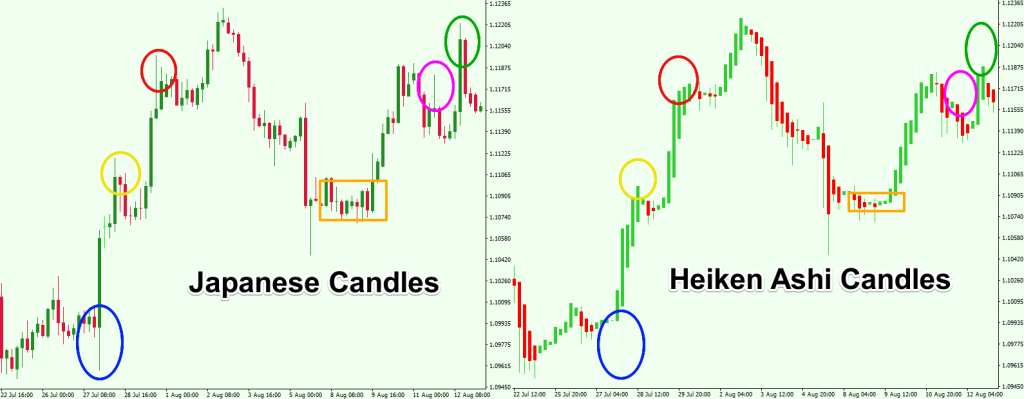

Heiken Ashi chart has an external resemblance to the Japanese candlestick chart. But in fact, they are based on a completely different algorithm for building bars, thanks to which minor market fluctuations are eliminated, and we have a reliable picture of what is happening at the concrete moment. It’s vitally important to use this type of chart in 1 minute strategy, because there are many extraneous price movements on the fifteen-second graph. It means that the Japanese candlestick make it difficult for us to navigate and understand the general market situation.

The Bollinger Bands indicator will show us the extent to which the price changes. It has special orange borders which can expand and contract. You should bear in mind that it’s not worth trading in moments when the channel is too wide or when the candlesticks break its borders. It’s better to wait out this period or choose another asset in order not to lose your money.

The channel should be as narrow as possible. In this case, price fluctuations do not go beyond its limits. Just wait until the bar reaches the top or bottom border and open a trade in the opposite direction. Use those assets that generate 80% of the profits. The method provides for stepped trading. That is, after losing, increase the ratio by 2.5 to recapture the loss.

To sum up, it’s possible to say, that AvaTrade 60 seconds strategy is not too complicated, but it involves some risks that can lead to the money loss. The candlestick can change its direction, a second before closing your deal, the deal closes in the negative, and then everything moves in the original direction. There are almost no such situations in long-term trading. But at the same time, when you use long-term trading, you cannot earn as great profit as it’s possible while using minute deals.